In the Wolters Kluwer 2023-24 Accounting Evolution survey, over 600 accounting firm professionals across ANZ and SEA were surveyed to gain insights on their technology adoption, current challenges and strategic priorities for the year ahead.

In last year’s survey results, amidst reports of a sector-based ‘boom’ for accounting firms, the number 1 goal reported for accounting firms focussed on improving job profitability and efficiency by improving operational workflows and standardising processes. Revenue growth was number 2.

This year revenue growth is back on top as the number 1 strategic goal for accounting firms. Firms which are expecting to meet or exceed their revenue targets in the year ahead provide some interesting insights for other firms to follow.

.jpg)

Technology adoption

Successful firms are using full cloud solutions and technology to gain efficiencies, and create the capacity required to generate new business and grow revenue.

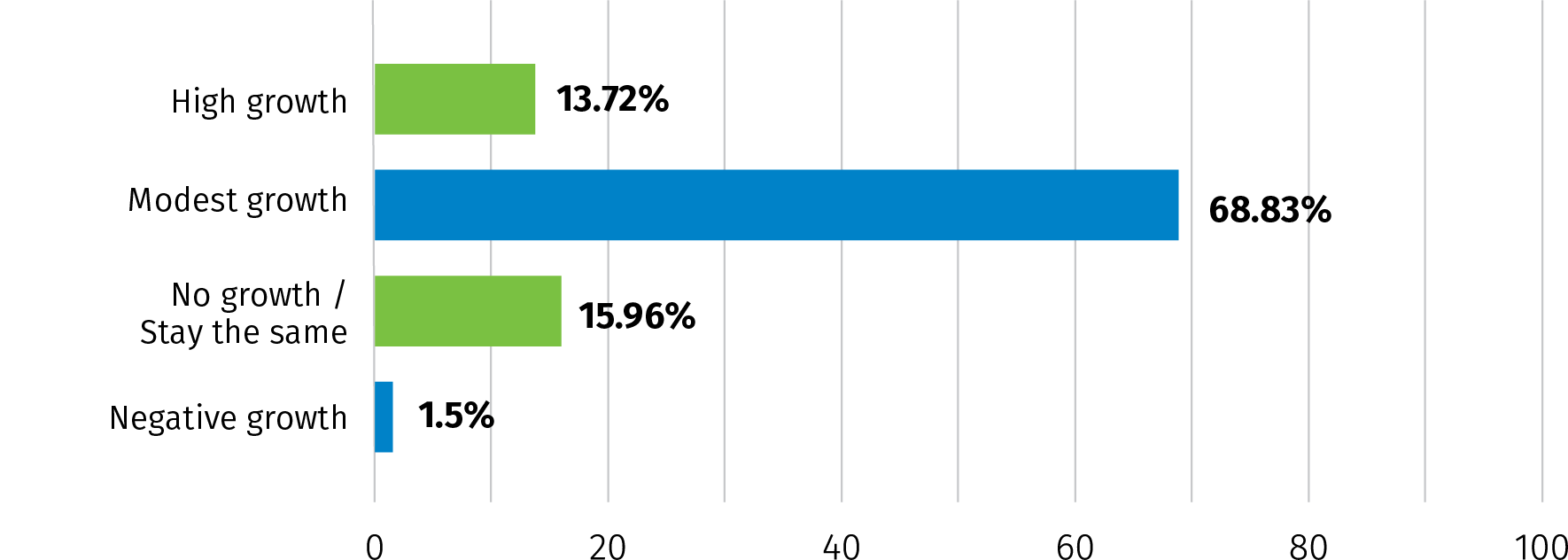

While the outlook overall is positive, with the vast majority of firms surveyed expecting at least modest growth over the next two years, a subset of 14% of surveyed firms are expecting high financial performance.

Twelve per cent of all firms surveyed self-identified as technology pioneers – proactively seeking technology to help their business.

Firms who are expecting high financial growth in the upcoming year are more likely to be technology pioneers or early adopters. While 80% of firms expecting low or no financial growth in the 2024 financial year consider themselves to be mainstream or lagging in technology uptake.

Firms with a positive financial outlook are fully embracing the cloud, with 73% already on the cloud for all solutions (compared to 54% of all firms surveyed).

Technology is proving critical, with over 70% reporting that technology implemented in their firm provides significant help to meeting business demands.

Technology implemented by your firm provides significant help to meet business demands

All firms: 63%

Firms expecting high financial growth: 70%

The key areas where technology is helping these firms include: reducing the hours spent on their jobs (59%), improving the quality and accuracy of their work (46%) and focussing on core business and billable work vs administrative duties (46%).

Unsurprisingly, these firms are also more confident in their ability to meet customer needs over the next 3 years.

Confidence in firm’s ability to meet customer needs over the next 3 years

All firms: 42%

Firms expecting high financial growth: 67%

Client Engagement

With efficiencies gained from technology adoption, successful firms are able to prioritise proactive client engagement, new business generation and growing their advisory services.

This is reflected in their strategic goals over the next two years, which differ from the survey average across all firms.

Top 3 goals for 2023-24

All firms

- Revenue growth

- Improve operational efficiencies

- Improve employee effectiveness

Firms expecting high financial growth

- Revenue growth

- Improve operational efficiencies / Grow advisory services

- Improve profitability / Improve customer engagement

Firms reporting high financial growth credit technology to impacting their ability to add new clients, retain more existing clients and add new services.

Technology helping to add new clients, retain more clients and add new services:

All firms: 36%

Firms expecting high financial growth: 65%

Successful firms are also proactively reaching out to a significant number of clients to inform them of relevant tax events (51%, compared to 43% of all firms surveyed), thus generating new potential revenue driving opportunities.

Efficiencies yet to be gained

While many firms are experiencing positive benefits from their adoption of cloud solutions and technologies, there are still further efficiencies to be gained.

The key issues firms are facing this year haven’t changed significantly year on year with data collection, talent engagement and work life balance remaining common challenges across the board.

However, for firms expecting high financial growth, the number 1 challenge is work life balance, suggesting that revenue growth is coming at a cost of human resource, with many efficiency benefits of technology that are not being fully maximised.

Top 3 issues currently facing your firm

All firms

- Obtaining correct data from clients on a timely basis (46.5%)

- Work life balance for you and your staff (43.0%)

- Attracting and retaining talent (42.8%)

Firms expecting high financial growth

- Work life balance for you and your staff (47.2%)

- Obtaining correct data from clients on a timely basis (41.8%)

- Finding the time to value add for clients / Attracting and retaining talent (40.0%)

To what extent are you maximising the benefits of your firm’s current technologies?

All firms: 9.4%

Firms expecting high financial growth: 15.1%

Further, while all firms report that integrated technologies for compliance, accounting and practice management solutions is a top requirement, 27% of all firms and 25% of firms expecting high financial growth are still using five or more different providers of software solutions.

At Wolters Kluwer, we provide integrated compliance, accounting and practice management software with our award-winning CCH iFirm platform. We also provide tax and accounting research through our CCH iKnow, CCH iQ and related expert content solutions; thus being able to unlock efficiencies in the typical end-to-end accounting workflow.

As firms look to save time, improve quality of work, job profitability and free up time to add advisory services without compromising work life balance, we believe adopting unified technologies across both software and research will be critical to achieving a competitive edge in the years ahead.

Be the first to receive the report when it’s available here.

.jpg)